How to Calculate the Operational Costs Behind Your Product

by Paul Vinuelas

Calculating your “fully loaded” operational costs for shipments is not an easy task. A lot of time is spent ‘guesstimating’ certain costs and while overlooking others. But unless you can get an accurate representation of how much your operational costs actually are, you will never be able to find ways to lower them.

Below is a breakdown of all major cost centers around fulfillment operations and how to calculate them. We’ve created this as a foundational reference for building out your business model.

How to Calculate Shipping Costs

This is one of the most commonly miscalculated costs in operations. If you are taking your costs from the “contracted rated chart”, then you will likely be off by more than 3-7% depending on the shipping service you are using. Another commonly incorrect way to estimate shipping cost is assuming you can take an average cost of your “zone chart”, or even worse, assuming the majority of shipments all go to one “zone”. All of these methods, while often used, are grossly inaccurate.

The answer to the question "how to calculate shipping costs" is to actually take the invoice that you get at the end of the month and work your way backwards. This will give you the true cost of each shipment, which will most likely shock you.

The 2 Best Ways to Calculate Shipping Costs

1. Take the total invoiced amount for the time frame specified in the invoice, and divide that by the total shipments referenced on the invoice.

Say you paid $15,736.27 total invoice for a given time period, and the total tracking numbers (shipments) during that timeframe was 2,675. Calculate shipping cost per item: $15,736.27 / 2,675 = $5.88. So your actual shipping cost per order is $5.88. Don’t worry about weight or zones, do this for a couple of invoices to calculate your true cost of shipping before accounting for other factors. This is to provide a baseline of true cost. Use EasyPost’s partnerships to successfully scale your business.

2. Take the data from your invoice and plug it into a spreadsheet for deeper analysis. At the very least, you’ll want to include these data points: Weight, Final Cost, Delivery State.

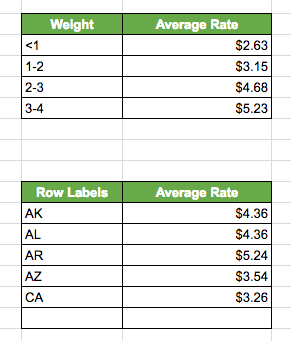

Create pivot tables around Weight, FInal Cost, Delivery State, and any other factor you’d want to analyze.

Tip: If you don’t know how to create pivot tables, learn here. Pivot tables are invaluable tools in understanding your operations.

The pivot table should allow you to calculate the average cost paid based on Weight and Delivery State. Using that info, you can now properly compare your true cost to what a 3PL will provide you.

Knowing your true shipping costs allows you to see where a big portion of your expenses are going. Taking the costs directly from the invoice allows you to properly factor in the additional fees that you will see from most carriers (e.g. delivery surcharge, fuel surcharge, residential charge, etc.).

Labor Costs

The second most often miscalculated cost for operations is the labor required to pick, pack and ship your orders. Most people take the hourly rate of an employee and estimate the cost based on the time it takes to ship orders in a given hour. The industry term for this is Units Per Hour (UPH).

Here’s an example of an incorrect calculation: Joe gets paid $15 per hour and has a UPH of 120. Therefore $15/120 = $0.125 per unit cost.

This formula fails to include benefit costs, temporary worker agency costs, and “stand around” time. “Stand around” time is a nicer symbol of employee downtime, since human employees are never 100% productive.

A better approach to calculate your labor costs is similar to shipping. Take the invoice (if you are working with a temporary agency) or ask your accounting department for a fully loaded spend in a given time period (say 1 month). This will include any fees and/or benefits that would be added on top of the $15 hour rate. Then, using that same time period, count how many total orders you shipped out in that month (don’t use estimates, get a confirmed count).

For example: Total cost for warehouse labor this month, accounting for benefits, temp agency fees, and average “stand around” time = $18,570.46 while total shipments from that warehouse this month = 17,560. Divide $18,570.46 by 17,560, and you get $1.06. This means you are paying a fully loaded cost of $1.06 per shipment. Do this for a few months to establish a good baseline for your average labor costs.

Storage Costs:

Storage cost is often overlooked in operations accounting because it usually goes to a different accounting bucket, therefore it usually isn’t included in your COGS (cost of goods sold). However, it is vital to know storage costs if you are trying to compare the costs of doing operations internally versus outsourcing to a 3PL.

A true storage cost is the actual cost to store your goods. If you have your own warehouse, then this will be easy to calculate with your monthly warehouse rent. But this usually isn’t the case since many SMBs leverage the storage associated with their office. The best way to calculate costs in this situation is this: take the area that you have designated to your operations team and calculate the percentage of that space compared to the overall space. Using that percentage, you can deduce the portion of the overall rent and insurance that should be applied to your operations. For example:

- Office = 30,000 sqft

- “Operations” space of the Office = 5,000 sqft (17% of office space)

- Office Monthly Rent = $100,000 / month

From here, it's an easy equation to find out how much you're paying to house your operations in your office. Just take out 17% from your $100,000 monthly rent (which equals $17,000), and you have the total rent cost for your operations. In order find out your storage cost on a per-package basis, divide your monthly storage rent ($17,000) from your monthly total orders (let's say it's 20,000). 17,000 / 20,000 = $0.85 per order.

Now that you know it's $0.85 per order to ship these products, you can use that number to determine your next warehousing steps. If you can maintain a $0.85 per order storage fee from internal warehousing, then by all means, continue warehousing your products internally. But if you can’t, use that $0.85 number as a baseline to determine which 3PL will give you the fairest storage cost.

Supply Costs

Aside from storage costs, supply costs are also commonly overlooked operation costs. It is easy to do, you don't necessarily buy supplies on a set schedule as you are building your business, and it’s easy to think things like tape, filler, or boxes don't cost much anyways. The truth is, these costs can creep up surprisingly quickly, and it's good to know how they factor into your per order costs.

Like labor costs, don’t look at it as a per unit variable, especially when you are trying to figure out how much tape should be allocated to a package. This rarely works out. Instead, you should summarize all your supplies in a given time period. When calculating average cost of supplies, it is best to take a longer time frame like 3-6 months. That’s enough time to get a good economic grasp on all the supplies you purchase.

This might sound difficult, but if you are ordering your supplies from a specific place like Amazon or Uline, you should be able to pull the cost of previous supply orders. Once pulled, you should apply them against the volume in the same timeframe. For example:

$5,768 was the total costs of Boxes, tape, paper void fill, shipping labels over the last 4 months. Over 4 months, you shipped out 11,348 orders. Divide 5,768 by 11,348, and you get $0.51, which is the supply cost per shipment for that quarter.

Conclusion

If calculated correctly, these main areas will allow you to see the true cost of your operations. Once you are armed with this knowledge you can now start to do proper “apples to apples” comparison. Knowing the actual cost of fulfillment - shipping, labor, storage, and supplies - gives you priceless knowledge when determining the operational model of your business. If you go internal, you’ll know how much it should cost. If you decide to outsource, you’ll be in a better place to negotiate prices.